Author’s Name : Adam Oliver

Institution’s Nam: Angela S. Ohara

This entry was posted in TheCasestudySolutions.com/ on by Case Study Assignment Help

Advices to achieve Financial Goals

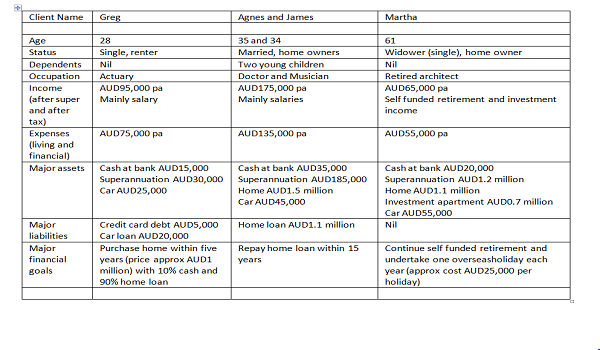

The first advice is relating to the case of “Greg”, who is a Junior Actuary with a Boutique Firm. In the future, Greg has two options, one is to join the company as a partner or start their own business. In either options, the earnings of Greg is expected to increase by five times. Due to his socializing and personal relationship, it is advised to Greg to go with the opening of their business instead of becoming a part of the organization at a senior most position. The potential of the income and the recommendation of the risk depends entirely upon the risk profile of the customers. It is found equally in the case of “Greg”. Greg is a risk taker and has the tendency to maximize their wealth by taking timely actions and risk. Hence, the strategy that will be informed to them should be managed in a professional way in particular for their core efficiency and perfection. This particular option would be more efficient and worthwhile for their efficiency and productivity of the individual, and helps them to achieve their long term goals in a more appropriate manner. Greg’s goal is to purchase a house in AUD 1 Million. With the job Greg might not get the desired fund, but business would be a better idea for their investment. Hence, Greg should invest. The investment recommendation has been given by eyeing over the factor of Greg, their personal income and the risk appetite which Greg wanted to achieve in a relative time period. In short, it can be said that the case of Greg would be an ideal one for the Active Investors who are more concerned and connected with the investment return instead of the mitigation of the risk factor. Therefore, it will be an essential aspect in the long run proficiency.

The second advice is relating to the case of “Agnes and James”. They are married and have a secure and happy life with two children. They want to have a certain idea of work-life balance through which they can easily secure their positioning in the market. Both of the individuals think that they can decrease their pay rate from 0.8 FTE to 0.6 FTE, so that maximum benefits and work life balance could have been attaining. The potential of the income and the recommendation of the risk depends entirely upon the risk profile of the customers. It is found equally in the case of “Agnes and James”. Agnes and James are risk averse investors which are not in the favor of taking high risk, because of their low risk tolerance level. Hence, the strategy that will be informed to them should be managed in a professional way in particular for their core efficiency and perfection. Based on the fact that they no other liability, so the option of reducing the pay cycle would be essential for them, and they should continue with the same aspect accordingly. Agnes and James want to finance the education of their children covering a cost of AU$ 100,000. They are getting the desired money with lower burden on their working, hence they should not invest anywhere.The investment recommendation has been given by eyeing over the factor of Agnes and James, their personal income and the risk appetite which they wanted to achieve in a relative time period. In short, it can be said that the case of Agnes and James would be an ideal one for the Passive Investors who are more concerned and connected with the risk mitigation instead of broaden of the return. Therefore, it will be an essential aspect in the long run proficiency.

Since Martha is having a comfortable time, and her children are well-settled, then there is no need of any risky investment. The potential of the income and the recommendation of the risk depends entirely upon the risk profile of the customers. It is found equally in the case of “Martha”. Marthais a risk averse investors which are not in the favor of taking high risk, because of their low risk tolerance level. The investment recommendation has been given by eyeing over the factor of Martha, their personal income and the risk appetite which they wanted to achieve in a relative time period. In short, it can be said that the case of Martha would be an ideal one for the Passive Investors who are more concerned and connected with the risk mitigation instead of broaden of the return. Therefore, it will be an essential aspect in the long run proficiency.The case clearly identifies that the current position of Martha is comfortable due to the amount which she is receiving on her retirement, which is indeed quite a favorable chance and positioning for them in the long run. Hence, she shouldn’t think about the risky investment, and enjoy the retirement life, which is able to finance their travelling to Italy.

Hence, she should not invest in risky investments. Based on the underlying and processed information, it can be said that the risk appetite for Martha is locating on a lower level, because she has nothing to lose from the underlying scenario. She is relying on her retirement income, and she doesn’t want to incorporate anything high in the same argument in particular. Therefore, Martha should not invest in the risky investment so that she can spare their life easily.